unified estate tax credit 2019

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect. Unified Tax Credit.

Historical Estate Tax Exemption Amounts And Tax Rates 2022

The unified tax credit applies to two or more different tax credits that apply to similar taxes.

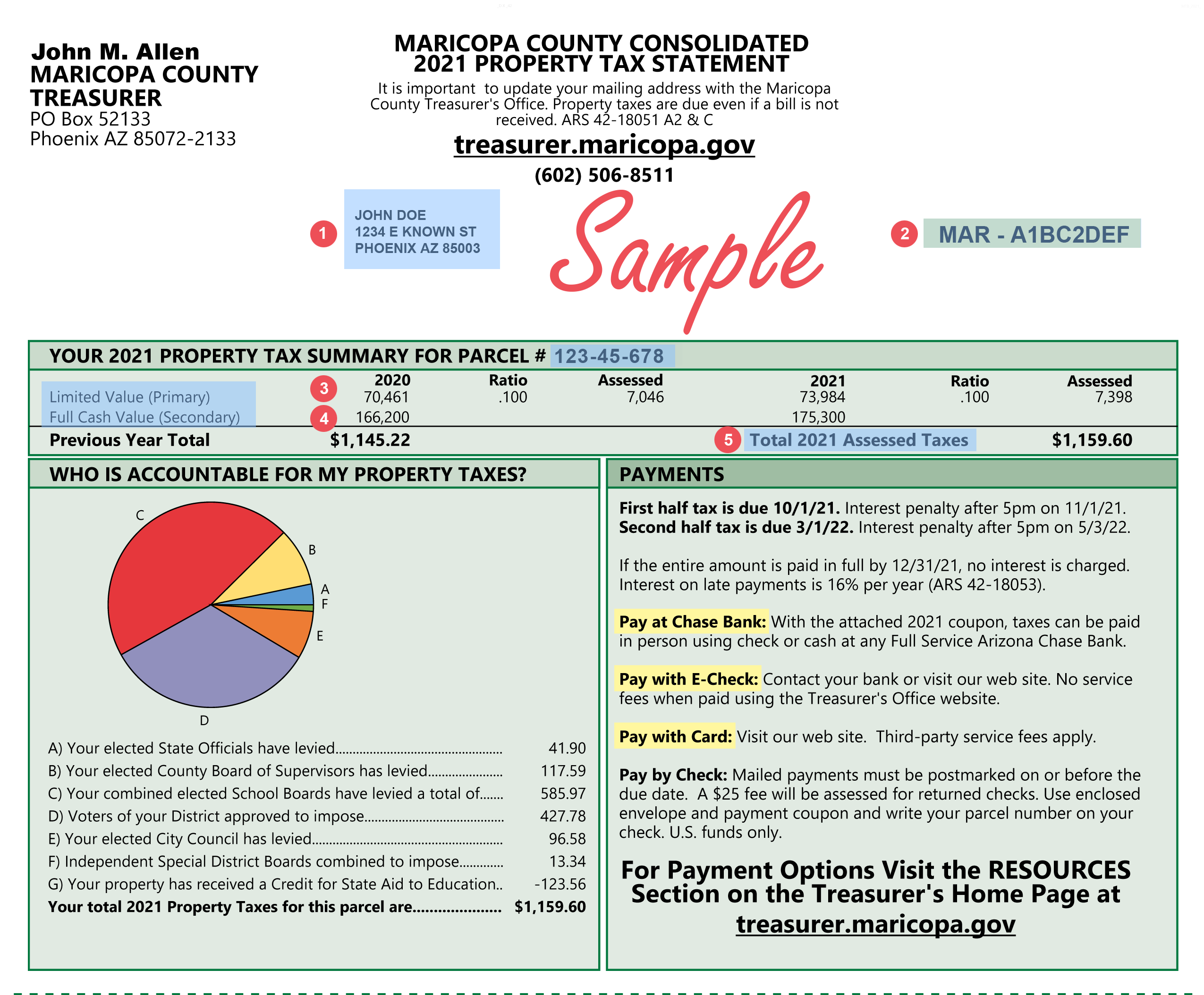

. Messages left on the estate tax lines will be monitored and callers will receive a response as soon as possible. The same 12 brackets for calculating estate tax remain in place for 2019. Most relatively simple estates cash publicly traded securities small amounts of other easily valued assets and no special deductions or elections or jointly.

A tax credit that is afforded to every man woman and child in America by the IRS. Is added to this number and the tax is computed. Unified credit for the estate tax and for the gift tax work under the same system so that taxable gifts made during life decrease the unified credit applicable to the estate tax.

How did the tax reform law change gift and estate taxes. The Internal Revenue Service IRS recently announced that the estate and gift tax exemption is increasing next year. Form 1098 if you paid real estate taxes andor mortgage interest.

Up from 1118 million per individual in 2018 to 114 million in 2019. There are differences for Minnesota requirements and Federal requirements. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels.

Qualified Small Business Property or Farm Property Deduction. Your available Unified Credit is effectively reduced from 1158 million to 11 million. Ad All Major Tax Situations Are Supported for Free.

Such election once made shall be. This credit allows each person to gift a. The estate and gift taxes for example have shared a unified rate schedule.

The tax reform law doubled the BEA for tax-years 2018 through 2025. If youre responsible for the estate of someone who died you may need to file an estate tax return. Under the tax reform law the increase is only temporary.

Form 1099-INT if you received interest from a bank account in 2019. Minnesota Filing Requirements Year of Death. In the case of estate and gift taxes the unified tax credit provides a set amount that any individual can gift during their lifetime before any of these two taxes apply.

The 2019 estate tax rates. Because the BEA is adjusted annually for inflation the 2018 BEA is 1118 million the 2019 BEA is 114 million and for 2020 the BEA is 1158 million. Form 1098-E if you paid student loan interest for post-high school education in 2019.

If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. Doing the math the 2019 unified credit is.

The 2019 estate tax rates. If you die in 2020 after making such a taxable gift you will still be. Thereby reducing the tax on an estate.

Free means free and IRS e-file is included. Start Your Tax Return Today. The tax is then reduced by the available unified credit.

A deceased spousal unused exclusion amount may not be taken into account by a surviving spouse under paragraph 2 unless the executor of the estate of the deceased spouse files an estate tax return on which such amount is computed and makes an election on such return that such amount may be so taken into account. What is the amount of the estate tax unified credit applicable to deaths occurring in 2020. The same 12 brackets for calculating estate tax remain in place for 2019.

Form 1098-E if you paid student loan interest for post-high school education in 2019. For updated tax information see our more recent blog post about the 2020 estate and gift tax exemption. The Estate Tax is a tax on your right to transfer property at your death.

The 2019 estate tax rates. If a person dies in 2019 she can. Max refund is guaranteed and 100 accurate.

This article is for the 2019 tax year. Doing the math the 2019 unified credit is 4505800 up 88000 from 2018s levels. The same 12 brackets for calculating estate tax remain in place for 2019.

500 South Second Street. Doing the math the 2019 unified credit is.

Ontario Income Tax Calculator Wowa Ca

Irs Announces 2017 Estate And Gift Tax Limits The 11 Million Tax Break

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Minister Of Justice And Attorney General Of Canada Announces A Judicial Appointment To The Tax Court Of Canada Canada Ca

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

How The Tcja Tax Law Affects Your Personal Finances

Here Are The 2020 Estate Tax Rates The Motley Fool

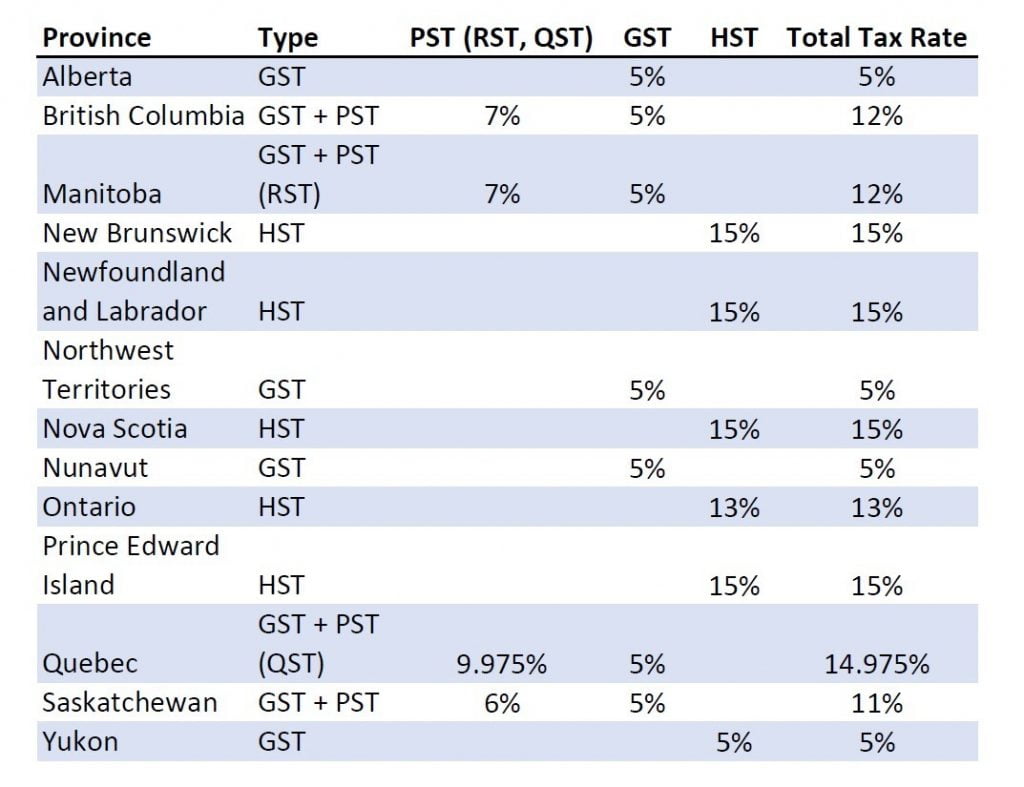

Provincial Sales Tax Pst For Business And Self Employed Individuals 101 Sdg Accountant

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

:max_bytes(150000):strip_icc()/UnifiedTaxCredit-d90e228472aa44e88eebc9866e3045d9.jpg)