what is fsa health care 2022

Affordable Healthcare Coverage for Families Individuals. Every dollar that you contribute to an HSA can pay for eligible medical expenses.

Hsa And Fsa Accounts What You Need To Know Readers Com

You must have a high-deductible health plan HDHP to open an HSA.

. Ad Save on fsa and hsa approved items. In addition as part of COVID-19 relief the. Braces and supports for athletes and orthopedic patients.

The IRS has announced the new health savings account limits for. However it cant exceed the IRS limit 2750 in 2021. For one self-employed individuals.

Like health care FSAs dependent care accounts are offered by employers to allow workers to set aside pretax money in this case to cover the expenses of caring for children or other family. Eligible fsa expenses 2022. FSAs only have one limit for individual and family health plan participation but if you and your spouse are lucky enough to each be offered an FSA at work you can each elect the maximum for a combined household set aside of 5700.

Everything from medical expenses that arent covered by a health plan like deductibles and co. An FSA is a tax-free way to pay for medical expenses. The FSA can help you save up to 40 of your personal expenses each year.

Heres a list of things that are qualified for the Health FSA and may be purchased without a prescription. Its a smart simple way to save money while keeping you and your family healthy and protected. Flexible Spending Account FSA An arrangement through your employer that lets you pay for many out-of-pocket medical expenses with tax-free dollars.

When you get medical treatment in. If you contribute the maximum amount to your FSA in 2022 youll have a total balance of 4350 to spend in 2022. You can use the money in your FSA to pay for many healthcare expenses that you incur such as insurance deductibles medical devices certain prescription drugs doctors office co-pays and more.

Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced. But the late announcement left. A Flexible Spending Account also known as a flexible spending arrangement is a special account you put money into that you use to pay for certain out-of-pocket health care costs.

Employees can use FSA funds to pay for eligible healthcare dental and vision expenses. An FSA is a tool that may help employees manage their health care budget. What happens to unused health care FSA.

Breast pumps and accessories are available. Get a Quote Now. You dont pay taxes on this money.

Health Care FSA. Ad Custom benefits solutions for your business needs. Plus if you re-enroll in FSAFEDS during Open Season you can.

Common purchases include everyday health care products like bandages thermometers and glasses. This means youll save an amount equal to the taxes you would have paid on the money you set aside. Elevate your health benefits.

Allowed expenses include insurance copayments and deductibles qualified prescription drugs insulin and medical devices. Acne light therapy is a treatment that uses light to treat acne. On March 27 2020 the Coronavirus Aid Relief and Economic Security Act CARES Act was signed into effect giving Health Savings Account HSA Flexible Spending Account FSA and Health Reimbursement Arrangement HRA participants access to 20K additional eligible products including.

If you have a dependent care FSA the annual contribution limits will be higher see section below. Health care FSAs and dependent care FSAs DCFSAs have annual contribution limits that you cant exceed during the year. For health-care FSAs only some employers allow you to carry over a certain amount up to 550 for 2021 into the next year.

1 day agoAn EPO plan is a type of health insurance that helps pay for medical care but only if its from doctors and hospitals within the plans network. Free 2-Day Shipping with Amazon Prime. What is an FSA.

Check the Newest Plan Options. Employers set the maximum amount that you can contribute. Later you can use this money to pay for qualified expenses such as medical care health-related products and other services.

The Internal Revenue Service IRS has announced an increase in the Flexible Spending Account FSA contribution limits for the Health Care Flexible Spending Account HCFSA and the Limited Expense Health Care FSA LEX HCFSA. Ad Join 2 Million Satisfied Shoppers weve Helped Cover. Employees in 2022 can put up to 2850 into their health care flexible spending accounts health FSAs pretax through payroll deduction the IRS has announced.

These are considered qualified medical expenses because they are covered by the plan. The IRS hasnt yet announced 2022 limits but your employer can tell you during open enrollment what limits they will be allowing. When you withdraw money from the account you wont have to pay taxes on the funds as long as they cover HSA-eligible.

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and vision care expenses - those not covered by your health care plan or elsewhere. The most you can contribute pre-tax to your account is 2750 in 2021 which is unchanged from 2020. Pre-tax dollars are put aside from your paycheck into your FSA.

In typical years any unused money in your FSA at the end of the plan year is forfeited unless your employer gives you a 25-month grace period to spend the money. The Navia Benefits Card will only load the amount contributed so far to your Day Care FSA. A health savings account HSA is a tax-exempt account set up to offset the cost of healthcare.

Free Torn Lens Replacement. A healthcare FSA is an employer-owned savings account that an employee funds through untaxed contributions. Heres how a health and medical expense FSA works.

The health FSA contribution limit is 2850 for 2022 up from 2750 in the prior year. The Navia Benefits Debit MasterCard. Easy implementation and comprehensive employee education available 247.

Dependent care fsa eligible expenses 2021. If you have a dependent care FSA pay special attention to the limit change. Your employer may also choose to contribute.

Ad Free Shipping No Hidden Fees. During your planned year you can spend the funds on these qualified medical expenses. This is an increase of 100 from the 2021.

The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. Healthcare FSAs are a type of spending account offered by employers. You decide how much to put in an FSA up to a limit set by your employer.

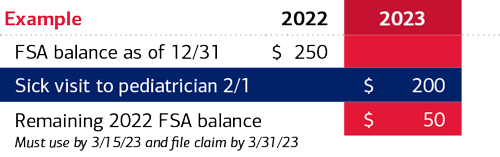

Over-the-counter OTC drugs and medicines like fever. For 2022 participants may contribute up to an annual maximum of 2850 for a HCFSA or LEX HCFSA. For plan year 2022 in which the HCFSALEXHCFSA contribution limit is 2850 employees can carry over 20 percent of 2850 or 570 to the 2023 plan year.

An FSA is not a savings account. Health savings account HSA contribution limits for 2022 are going up 50 for self-only coverage and 100 for family coverage the IRS announced giving employers that sponsor high-deductible. Flexible Spending Account FSA An FSA is similar to an HSA but there are a few key differences.

For plan year 2021 the HCFSALEXHCFSA carryover limit to the 2022 plan year is equal to 20 percent of 2750 or 550 to the 2022. Get a free demo.

What Is An Fsa Definition Eligible Expenses More

Fsa Eligible Items And Expenses Of 2022 Best Ways To Use Your Fsa Dollars Cnn Underscored

Health Care Flexible Spending Accounts Human Resources University Of Michigan

What Is A Dependent Care Fsa Wex Inc

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

Understanding The Year End Spending Rules For Your Health Account

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Understanding The Year End Spending Rules For Your Health Account

Hra Vs Fsa See The Benefits Of Each Wex Inc

:max_bytes(150000):strip_icc()/GettyImages-629388550-e4fd4d3f5b094ad099fb0d68e42e2d4c.jpg)

Does Money In A Flexible Spending Account Fsa Roll Over

Health Cards Healthcare Hsa Fsa Or Hra Cards Visa

What S The Difference Between An Fsa And Hsa Forbes Advisor

Flexible Spending Account Contribution Limits For 2022 Goodrx

Fsa Carryover What It Is And What It Means For You Wex Inc

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

2022 Irs Hsa Fsa And 401 K Limits A Complete Guide

/flexible-spending-account-fsa-written-on-a-wooden-cubes--1070418618-74ab17cbd81e44fdbd5cf019a02c2593.jpg)

Flexible Spending Account Fsa Definition

Health Care And Limited Use Fsa Human Resources Northwestern University

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc